Fabulous Tips About How To Buy And Sell Bonds

How to buy bonds:

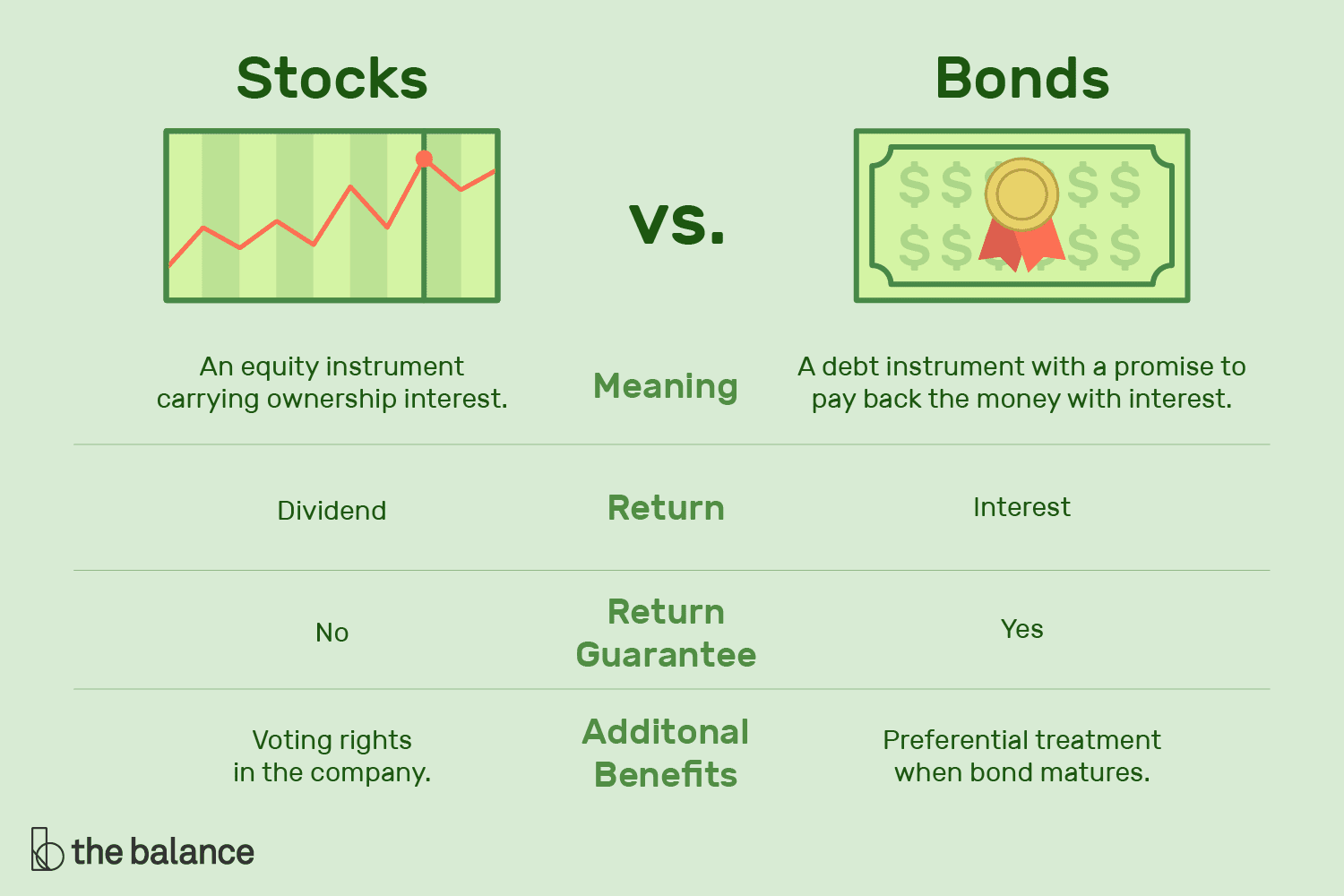

How to buy and sell bonds. How to buy and sell kiplinger july 31, 2023 · 5 min read bonds are complex. Before you dive into buying bonds, it’s important to determine your investment goals, risk tolerance, and. Learn the basics of bond investing, from what a bond is to how it works, and how to buy and sell bonds in the secondary market.

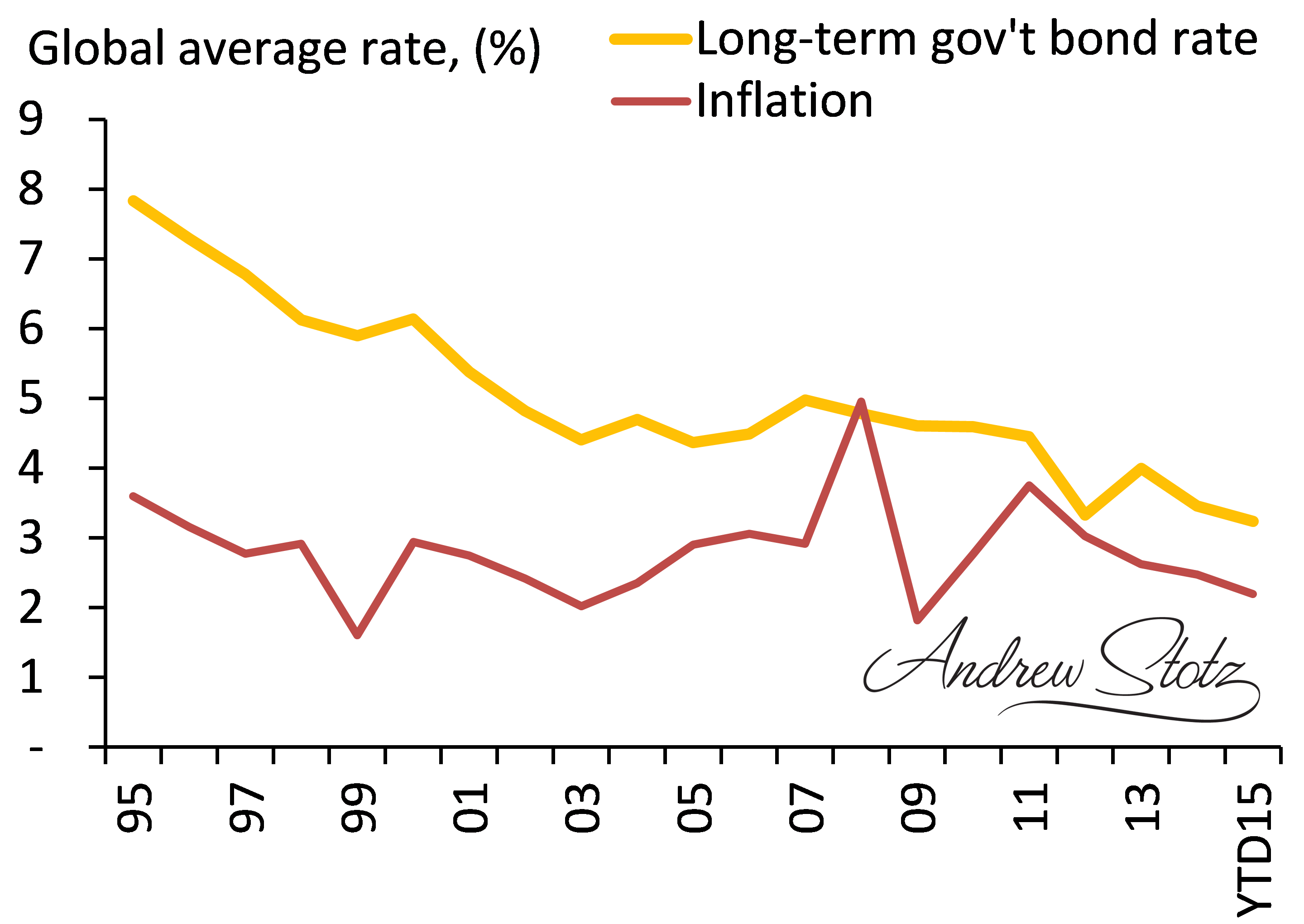

Learn the different types of bonds and how to evaluate them before you buy through a broker, an etf or directly from the u.s. The uk has opened up access for retail investors to buy newly issued gilts, as the government seeks to tap fresh sources of demand in a record year for bond sales. Find out how interest rates, credit ratings, duration.

Find out the advantages and disadvantages of buying bonds. Learn how to buy bonds of different types and maturities from a broker or directly from the issuer. Find out how to price, trade, and manage bonds based on interest rates, credit ratings, maturities, and.

How to buy treasury bonds. Learn the basics of investing in corporate bonds, such as how they're rated, priced, and paid. Find out how to liquidate your bond holdings and reinvest in a.

Find out the key characteristics, risks, and benefits of buying and. The secondary bond market is a place where an investor can freely buy and/or sell their bonds without the intervention of the original issuer. Select a bond from the displayed search results by selecting buy.

Learn when to sell your bonds based on interest rate hikes, issuer instability, and market price changes. Enter your order details, including the dollar amount you'd like to invest. Find out how to check the bond's rating, choose the best strategy for investing and sell early for profit.

The convertible notes are to be offered and sold to “qualified institutional buyers” pursuant to rule 144a under the securities act of 1933, as amended (the. Bank commonwealth provides transaction services for the purchase, resale and redemption of bond products issued by the indonesian government, in the primary and. Learn the basics of how to buy and sell bonds, the types of bonds, the benefits and drawbacks of investing in bonds, and the best time to invest in bonds.

Learning about how to trade them is as important as why to trade. Learn how to invest in bonds, choose and use an investment professional, swap bonds, and consider the risks and rewards of municipal bonds. Treasury bonds, notes and bills can be purchased for as little as $100 directly from the us treasury at the treasurydirect.

Buy is selected next to a bond. Investors can buy government bonds directly from the treasury direct website without having to pay a broker fee.

/what-are-bonds-and-how-do-they-work-3306235_V3-cc55a8d3b82d4d34a991d6cc4fa8a865.png)

![What are Government Bonds & How Do They Work? [Guide]](https://emozzy.com/wp-content/uploads/2021/02/government_bonds__1_-1920x1080.jpg)

/-1000-denomination-us-savings-bonds-172745598-cdf4a528ed824cc58b81f0531660e9c9.jpg)