Neat Info About How To Handle An Irs Audit

Reviewing your accounts by irs auditors to ascertain compliance with u.s.

How to handle an irs audit. Choose your debt amount 5,000 get tax help in minutes The irs can request to audit either individual or business accounts. Often this is the best way to prevent the audit from escalating beyond the original areas that attracted the irs's interest.

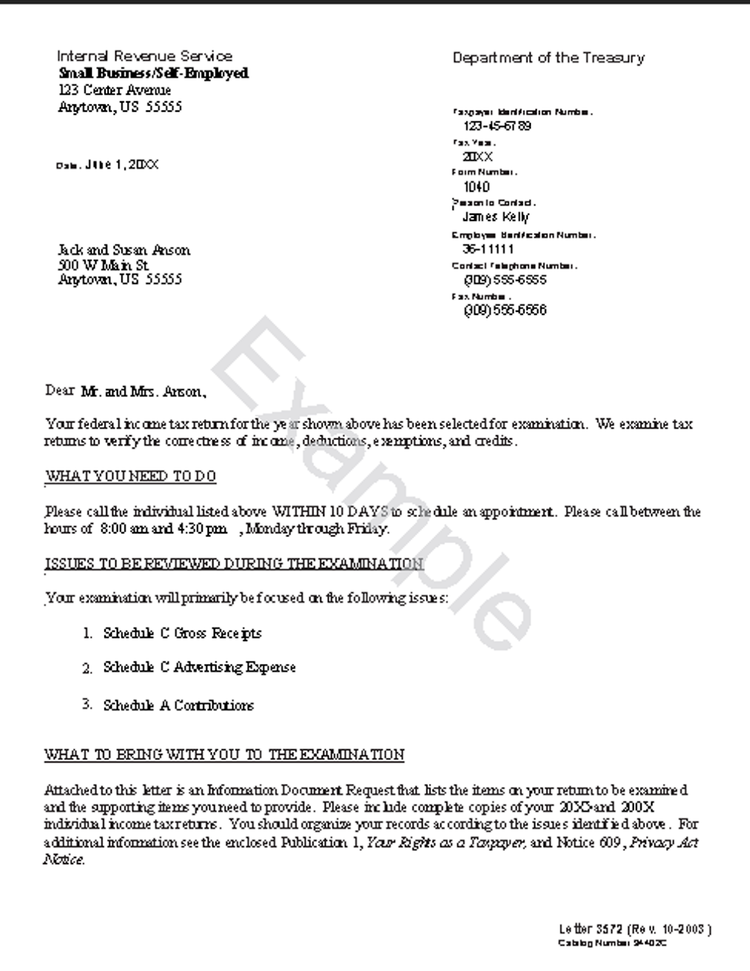

The taxpayer bill of rights is grouped into 10 easy to understand categories outlining the taxpayer rights and protections embedded in the tax code. If you are having a hard time preparing for a tax audit, there is help available. Mail audits are limited to a few items on the audit letter you received from the irs.

How to handle an irs audit of your tax return. The irs finds out you owe them money. Audits are not always indicative of wrongdoing;

Your federal tax return has been selected for examination. few pieces of correspondence evoke as much anxiety as an audit notice. While an irs audit typically carries a negative connotation, designation for an audit is not a steadfast indicator of any wrongdoing. Getty images once you receive notice you're being audited, don't.

By susannah snider, cfp | nov. How to survive an irs tax audit don't panic during a federal tax audit. Facing an irs audit can feel overwhelming, but with a clear understanding of the process and your rights, you can navigate this experience with confidence.

The irs expects taxpayers to keep the original documentation for capital assets, such as real estate and investments. Tax audits usually start with a. Math errors are common, and also easy to catch.

If the irs audits your tax return, the irs is taking a close look at your return to see whether you included all your income, and took only the deductions and credits you were allowed by law. The irs conducts audits in two ways. For underreporter notices, the average amount owed is about $1,500.

Here are the five most common audit red flags—and what to do to avoid them. To handle the audit process well, you will need to understand the internal revenue code or tax code, which includes more than 8,500 pages of fine print. Keys to success in handling an irs audit include being well prepared, establishing credibility, and keeping your wits about you.

The interview may be at an irs office (office audit) or at the taxpayer's home, place of business, or accountant's office (field audit). A correspondence audit is handled through letters. However, it selects some for an additional review or audit.

What documentation you need to provide; The irs finds out you don’t owe them any money, and leaves you alone. The audit process: