Supreme Tips About How To Get A Start Up Loan

Typically, 8% to 13%, but can vary based on the lender.

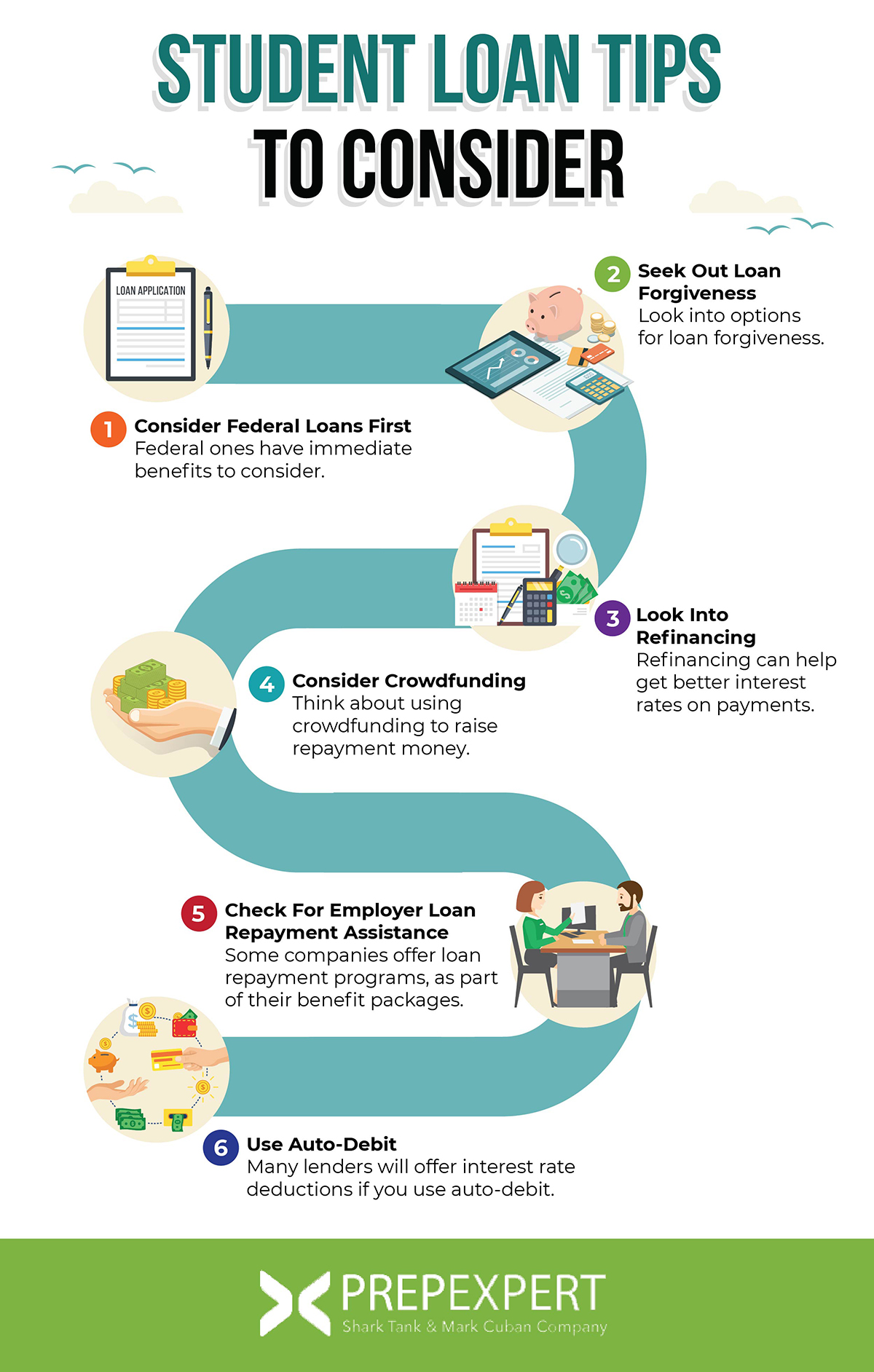

How to get a start up loan. Be sure to acknowledge the risks along the way. See if you could be eligible for a start up loan and apply online info. Though not technically loans, startups can also use business credit cards, invoice financing, and crowdfunding.

How to get a loan to start a business; Use these steps when applying for a startup loan: Managing and expanding a new business.

Zero to seven years interest rates: Job growth but are much more likely than larger firms to face financial challenges accessing borrowed capital. Get your financial requirements and business plan together.

How to get a startup business loan 1. President biden starts notifying more than 150,000 student loan borrowers enrolled in the save plan that their debts — totaling $1.2 billion — have been forgiven. As a startup, it may be more difficult to get more traditional forms of.

To get a startup business loan, you’ll need to follow the following steps: Determine how much funding you need. What to do if you’re rejected;

Show the bank a business plan that demonstrates how your business will succeed. Here are the best startup business loan options. The start up loan scheme is the main source of government support for new businesses in the uk.

Here are four common types of startup loans: Evaluate what kind of loan you need. Unlike a business loan, this is an unsecured personal loan.

With the government’s start up loan scheme you can borrow an amount from £500 to £25,000. How can a startup loan help your small business grow? Start by making a list of your expenses including rent, equipment, inventory,.

Whether you want funding to start a business or to expand, here’s a list of steps you can take to get started: Home > finance > loans the 5 best startup business loans of 2023 business.org reviews lendio, bluevine, and other top lenders for startups. The smes loan programme is one of the most popular financing options for new business owners in indonesia, with many banks offering startup loans to help entrepreneurs start a business.

You might also consider borrowing from friends and family to kickstart your startup business. 0% (for up to 21 months) to 15% fees: Applying for an sba loan can feel daunting because of the eligibility requirements and application procedures.